The stock market is one of the most effective ways to build wealth, but for beginners, it can feel overwhelming. Understanding how it works is the first step to becoming a confident investor.

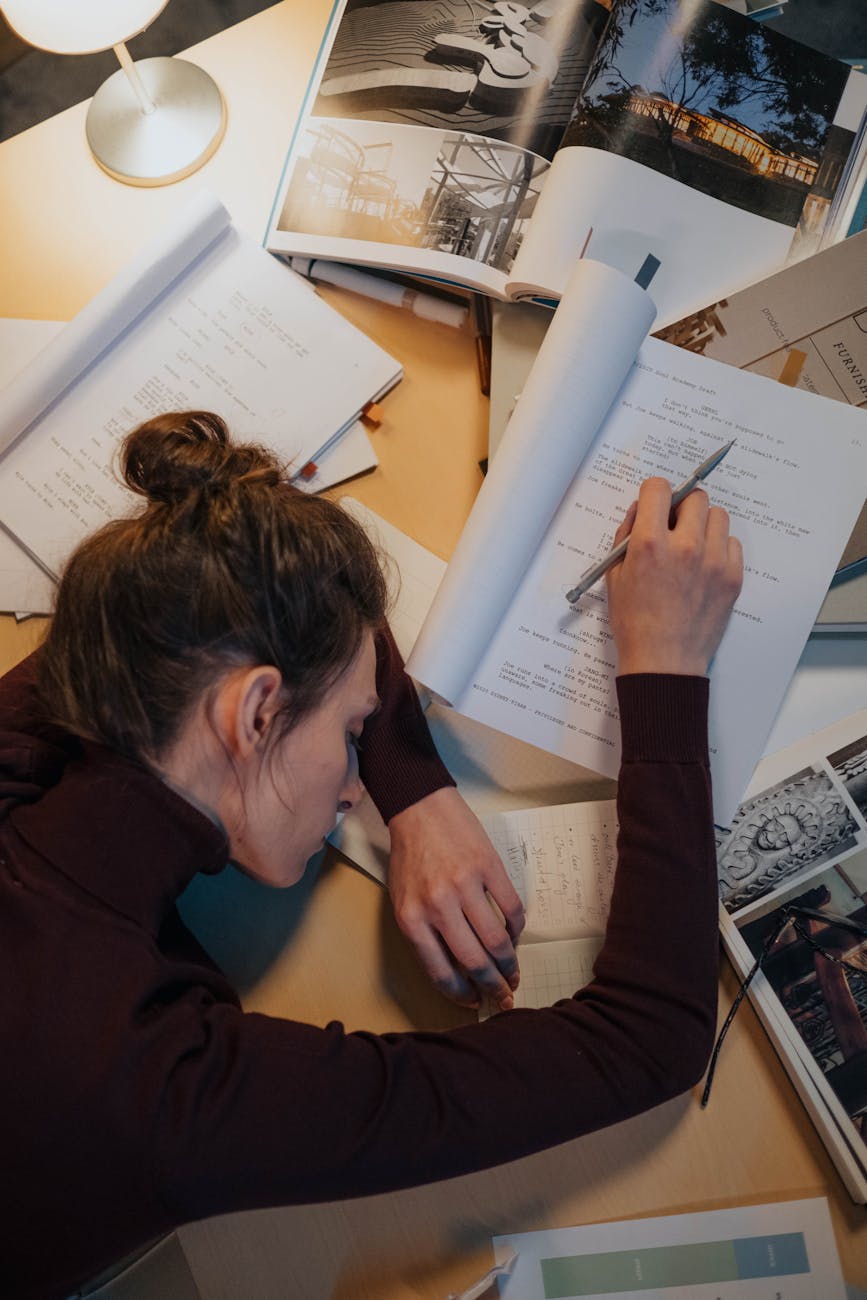

This blog series will break down stock market fundamentals into easy-to-understand parts, helping you learn step by step.

What Is the Stock Market?

The stock market is a marketplace where investors buy and sell stocks (also called shares or equities). When you purchase a stock, you own a small portion of that company. If the company grows and performs well, your stock value increases, allowing you to make a profit when you sell.

Why Do Companies Sell Stocks?

Companies sell stocks to raise capital for expansion, research, and operations. Instead of borrowing from banks, they allow the public to invest in their business. This process is called an Initial Public Offering (IPO)

. For example, when Facebook (now Meta) went public in 2012, it raised billions of dollars by selling shares to investors worldwide.

Why Do People Invest in Stocks?

People invest in stocks for several reasons:

1. To Build Wealth – Stocks generally offer higher returns than savings accounts or bonds.

2. To Earn Dividends – Some companies pay part of their profits to shareholders as dividends.

3. To Beat Inflation – Inflation reduces the value of money over time, but stocks have historically outperformed inflation.

4. To Own a Part of a Business – Buying stocks means you own a share of the company and may have voting rights on key decisions.

How Does the Stock Market Work?

The stock market operates through stock exchanges, such as:

• New York Stock Exchange (NYSE)

• NASDAQ

• London Stock Exchange (LSE)

These exchanges facilitate buying and selling of stocks. Prices constantly fluctuate based on supply and demand, company performance, economic conditions, and investor sentiment.

Who Are the Key Players in the Stock Market?

Several participants influence the stock market:

• Investors: Individuals and institutions that buy and sell stocks.

• Brokers: Middlemen who execute trades on behalf of investors.

• Companies: Businesses that issue stocks to raise money.

• Market Makers: Institutions that help maintain liquidity and smooth trading.

What’s Next?

This blog is part of a Stock Market Basics Series, where we’ll break down the essential concepts of investing. We are publishing it part by part, so stay tuned for the next installment!

If you’re new to investing, don’t worry—we’ll take it step by step. Follow along, and by the end of this series, you’ll have a solid understanding of how the stock market works!

Stay tuned , and share !!!!